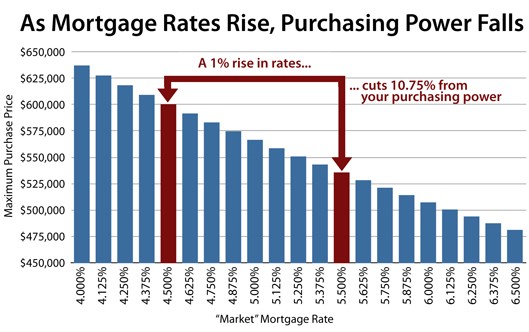

| A rate increase could harm your buying power more than increasing home prices. If the mortgage interest rates rose by 1%, the effect would be the same as if a house rose by 10% in price! For example, suppose you were qualified to spend $1,200 on a mortgage payment, with a 30-year fixed interest rate of 4.5%, and a 20% down payment. With all that, you could afford a home of $295,000. Now, raise the interest rate just 1% to 5.5%. Your buying power would drop by $30,000! You would only be able to afford a home of $265,000. For this reason, it’s important to lock into the lowest rate you can now, while rates are still low. What about Waiting for Prices to Drop? Even though property values may drop in coming months and years (though they are just as likely to remain stable), your purchasing power may drop faster than home prices as interest rates begin to climb. No one has a crystal ball, but barring unforeseen circumstances, the real estate market will likely remain strong for years to come. If you’re waiting for prices to fall before buying, you may be waiting a long time. Meanwhile you’re missing out on building equity and living in your own home. Call to set up an initial consultation with me. I’ll take all the time you need to answer your questions and lay out a home buying plan that makes sense for you in this market. (718) 399-3320 henrywattsrealestate1@gmail.com |

As Mortgage Rates Rise, Purchasing Power Falls