There have been identifiable real estate cycles in North America for hundreds of years. The peak of most of these cycles occurs about every 15 to 23 years.

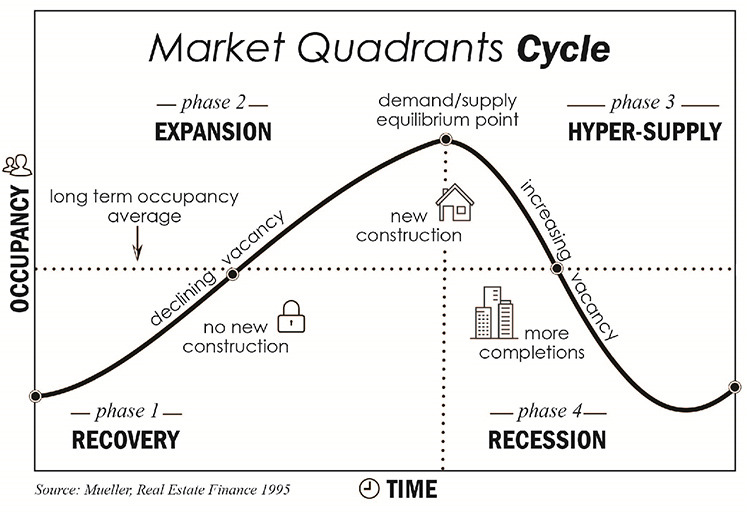

The four phases of the real estate cycle are: 1. Recovery from the previous recession. 2. Expansion. 3. Hyper Supply. 4. Recession again.

Clearly, we have been in an expansion for the past 5 or 6 years that’s been particularly steep—and on track to be longer than past expansions. Unclear is what is going to happen next. Usually, we see a glut of homes on the market as more and more people try to sell, at the same time as new construction ramps up, and the economy slows down.

But this has been an unusual expansion, so it stands to reason we’re in for an unusual contraction. I can only speculate on what that looks like…which I won’t do here. While I hate to speculate, I will say that there has always—always—been a contraction.

When will that occur? Indicators are muddled due to changes in technology and the effects of COVID. It could be many more years of expansion. Or just a few.

The best advice I can give right now is to move when you want and buy what you can afford. Even if you pay a premium, you’ll be in a home of your own, and that makes all the difference:)