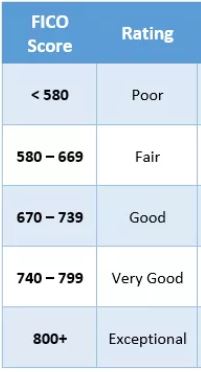

A FICO score is a score of your credit worthiness, created by the Fair Isaac Corporation (FICO). FICO scores take into account data in five areas to determine creditworthiness: Payment history (35%), current level of indebtedness (30%), types of credit used (10%), length of credit history (15%), and new credit accounts (10%). Scores can range from 300 to 850.

Fair Isaac is a data analytics company based in San Jose, California, founded by Bill Fair and Earl Isaac in 1956. Learn more.